Vulnerable customers

Identifying and responding to vulnerable customers

How to identify and respond to vulnerable customers in financial services contact centres

Today, vulnerable customers are a critical focus for financial services providers:

- The pandemic has dramatically increased the number of people classed as vulnerable.

- Regulators are applying more pressure on firms to spot vulnerable customers and demonstrate that they are treating them fairly.

- Signs of vulnerability are often evident during contact centre conversations- but not always identified by agents or conventional QA processes.

What is a vulnerable customer?

The UK’s FCA defines a vulnerable customer as: “someone who, due to their personal circumstances, is especially susceptible to harm – particularly when a firm is not acting with appropriate levels of care”.

Different types of vulnerability

The FCA’s guidance includes 4 key drivers of customer vulnerability.

Voyc guide

Download the Voyc guide to identifying and treating vulnerable customers fairly in financial services contact centres:

- Understanding what defines a vulnerable customer.

- How to identify vulnerable customers in your own business.

- How to respond to vulnerable customers in a way that ensures they’re treated fairly.

How to spot a vulnerable customer

Customers are unlikely to declare that they are vulnerable when speaking to a contact centre agent.

However, many customers will readily make comments that indicate a degree of vulnerability:

- Understanding what defines a vulnerable customer.

- How to identify vulnerable customers in your own business.

- How to respond to vulnerable customers in a way that ensures they’re treated fairly.

Other spoken clues are perhaps less obvious, but potentially even more important, such as:

“My partner used to deal with financial matters and I find it confusing now I have to do it alone”.

Beyond this, many signs of vulnerability in contact centres lie in how the customer behaves on the call rather than what they explicitly say.

Vulnerable customers examples

This is perhaps the most obvious sign of vulnerability. It can be related to a range of causes – such as poor mental or physical health, redundancy, low resilience or an inability to understand financial matters.

This kind of vulnerability ranges from customers simply sounding “flustered” through to indications of serious emotional turmoil. Dealing with these calls can also be upsetting for contact centre agents, who may even need support from others as a result.

Some contact centres appoint specially trained agents to whom such calls can be transferred for sympathetic and successful handling.

Hearing impairment is another straightforward indication of vulnerability, sometimes related also to age.

Other customers might find telephone conversations difficult due to limited English language skills.

In this situation, it could be appropriate to offer the customer different communication options – such as email or live chat.

Similarly, visually impaired customers might report difficulty in reading information sent by post or in emails. For them, other options such as large print documents or audio messages could be offered.

This could indicate cognitive impairment and illness – or lack of confidence due to an unhappy life event. For example, the customer might have recently lost a spouse or partner who used to take care of financial matters.

Sometimes, people in these situations are embarrassed to say that they don’t understand. Here, it can be helpful for the agent carefully to ask questions to check the customer’s comprehension – and to simplify or rephrase the point if required.

- The customer asks questions or makes points unrelated to the matter being discussed.

- The customer constantly repeats comments already made.

- The customer is hesitant and slow in answering questions – or loses track of what he or she is saying.

Voyc white paper

Download the Voyc white paper on vulnerable customers

- Why treating vulnerable customers is now a major regulatory and moral focus for financial services providers.

- How you predict likely vulnerability categories in your own business, using the FCA’s definitions of vulnerable customer categories.

- More details on how Voyc can help you monitor 100% of your contact centre calls to maximise the effectiveness of your vulnerable customers policy.

Building your own vulnerable customers policy

The kinds of customer vulnerability your business will encounter depend on the nature of your customer base.

For example, a firm with an older customer base, such as a traditional life insurer, will tend to see different signs of vulnerability than a recently launched credit card provider.

Observing the FCA’s guidance, every firm should take steps to define and understand the likely kinds of vulnerability amongst its own customers – as the basis of a strong vulnerable customers policy.

We hope that the insight on this page is helpful to you in doing this. You can also find more detailed information to help you in the Voyc Guide to identifying and treating vulnerable customers fairly and the Voyc White Paper on Vulnerable Customers.

Let us help you build your vulnerable customers policy.

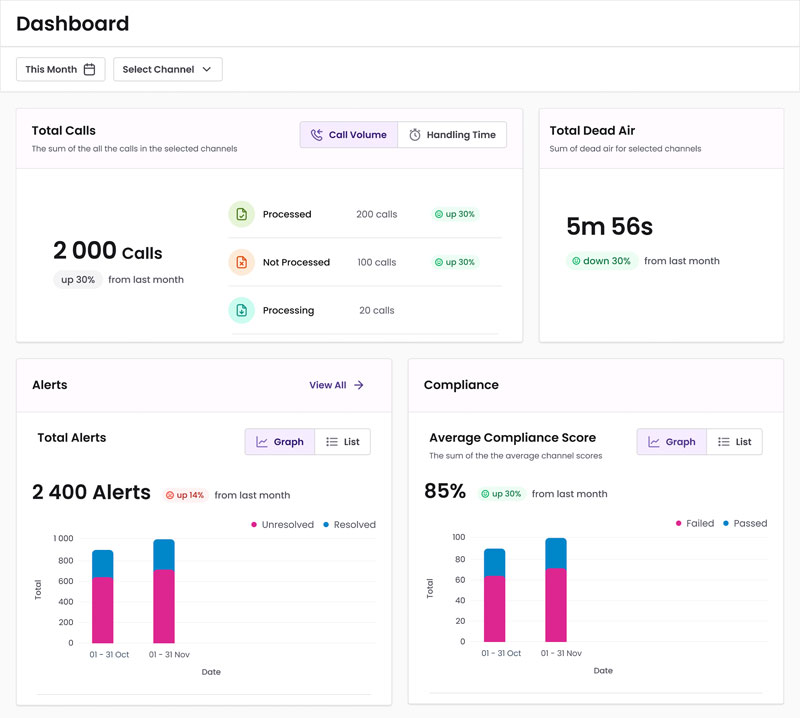

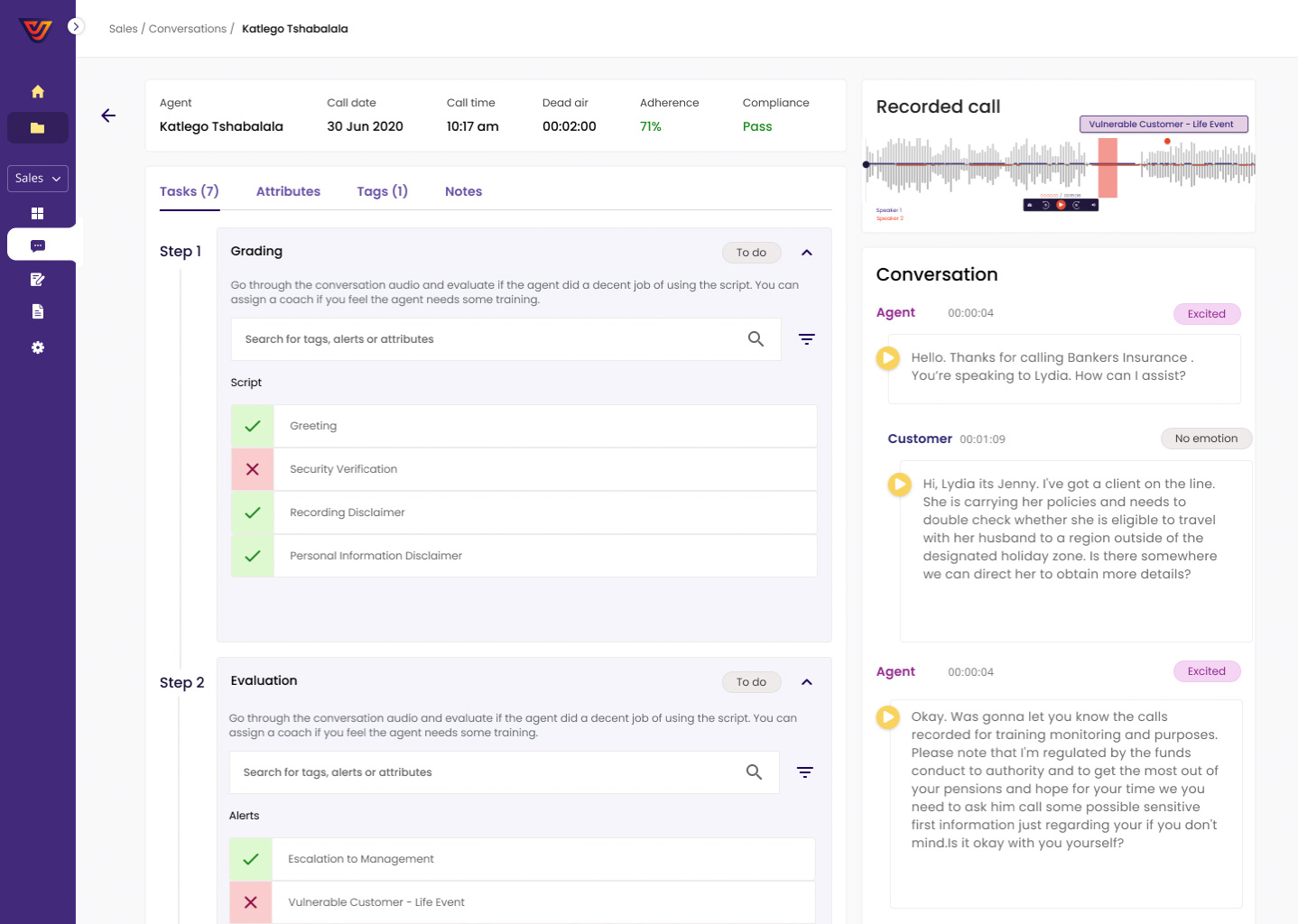

How Voyc can supercharge your contact centre’s ability to identify and respond to vulnerable customers

Voyc is a cloud-based AI software solution that lets you monitor 100% of customer calls in your contact centres. This means that the chances you might fail to notice and respond to signs of customer vulnerability are massively reduced.

Fast and cost-effective to implement

Let Voyc help you boost your ability to identify vulnerable customers easily – and you could be up and running in as little as just one day.

Three ways to find out more

Download Voyc guide

Download the Voyc guide to identifying and treating vulnerable customers fairly on financial services contact centres

- Understanding what defines a vulnerable customer.

- How to identify vulnerable customers in your own business.

- How to respond to vulnerable customers in a way that ensures they’re treated fairly.

Download the Voyc white paper

- Why treating vulnerable customers is now a major regulatory and moral focus for financial services providers.

- How you predict likely vulnerability categories in your own business, using the FCA’s definitions of vulnerable customer categories.

- More details on how Voyc can help you monitor 100% of your contact centre calls to maximise the effectiveness of your vulnerable customers policy.

If you’d like to book a free demo of Voyc in action on your own screen, click here to open the calendar and select a date and time of your choice.